Return on Diversity #8 – Calling all investors: Do you know your own biases in your early Due Diligence?

Calling all Investors: Do you know your own biases in your early Due Diligence?

Research indicates that in some contexts investors are prone to biased decision making, and that could, in turn, lead to bad investment decisions. That’s why – as an early Christmas present – Bootstrapping gives you ’The Investor Bias Checklist’. In the article below we look at five of the most central biases that could affect your decision making – and at the same time may be holding back gender balance in the ecosystem!

This is no. #8 article in a series about the lack of gender balance within the Danish startup eco system, Bootstrapping are publishing from our guide Return on Diversity. The guide is a collaboration between Bootstrapping, Female Founders of the Future and Nextwork sponsored by Danske Bank and ITB, and supported by Vækstfonden and Danish Business Angels. It’s mission; to provide tools and guidelines for founders, investors and for those who organise investments, on how to help fix the gender imbalance in the Danish startup ecosystem.

“The biggest investing errors come not from factors that are informational or analytical, but from those that are psychological”

– Howard Marks, Investor, Oaktree

Potential: Better early due diligence

Minimising bias in the early due diligence, e.g. in the pitching phase, could give you a more accurate perception of the startup potential on offer – whether male or female founded.

Problem: Decisions driven by unconscious bias

As an investor, it may be tempting to think that the gender balance can be fixed, solely through better deal flow. That there is no bias against female founders, and that we just need to figure out how we get a bigger volume of investment cases with women in the founder teams. However, as we have thoroughly documented in the guide, there are a number of reasons why the typical pitch format and investment decision biases might unfairly disadvantage female founders.

Solution: The Investor Bias Checklist

A number of biases might lead you as an investor to unintendedly invest in a way that favours male over female teams. Below is a list of five of the most central biases to be aware of, when making investment decisions – and perhaps more importantly: how to counter them.

-

Confirmation bias

The bias: We tend to confirm what we already believe, and try to falsify what we think is wrong. This tendency is called the confirmation bias, and leads us to make worse decisions by not updating our (subconscious) beliefs, e.g. that women are less “entrepreneurial”, to the actual evidence.

How to counter it: Actively look for examples that counter the assumptions that would lead you to not invest in a female founder. Or you flip questions, to challenge your assumptions (e.g. If a man said this, would I perceive it differently?).

-

Availability bias

The bias: How familiar something feels, affects how we think about it. If a market or an entrepreneur feels different, we might, just because of novelty, find their proposition more risky.

How to counter it: Be aware, that the feeling of something unknown to you, might lead you to dismiss it prematurely. Take extra time to consider these ideas, they might be even better investments, in the cases where novelty is in fact innovativeness.

-

Interpreting the same behaviour, differently for men and women

The bias: Because our expectations of women are often implicitly different from our expectations of men, our interpretation of what female vs male founders do and say – even when they say and do exactly the same thing – can be very different.

How to counter it: Be aware of the common pitfalls of evaluating women different from men:

1. Judging men for having potential, women for experience,

2. Judging men for trustworthiness, and women for competency,

3. Seeing enthusiasm as positives for men, and as “hectic” for women, and

4. Judging women harder on soft skills, and men on task-related skills.

-

Asking “win”-questions to men, and “lose”-questions to women

The bias: Even at the tables of VC funds men are more likely to be asked about their dreams, visions, progress and ideals, women were asked about security, responsibility, guarantees and potential pitfalls19. We ask men to win, and women not to lose. Importantly, the entrepreneurs that answered win-questions, were more likely to be evaluated positively, and receive funding.

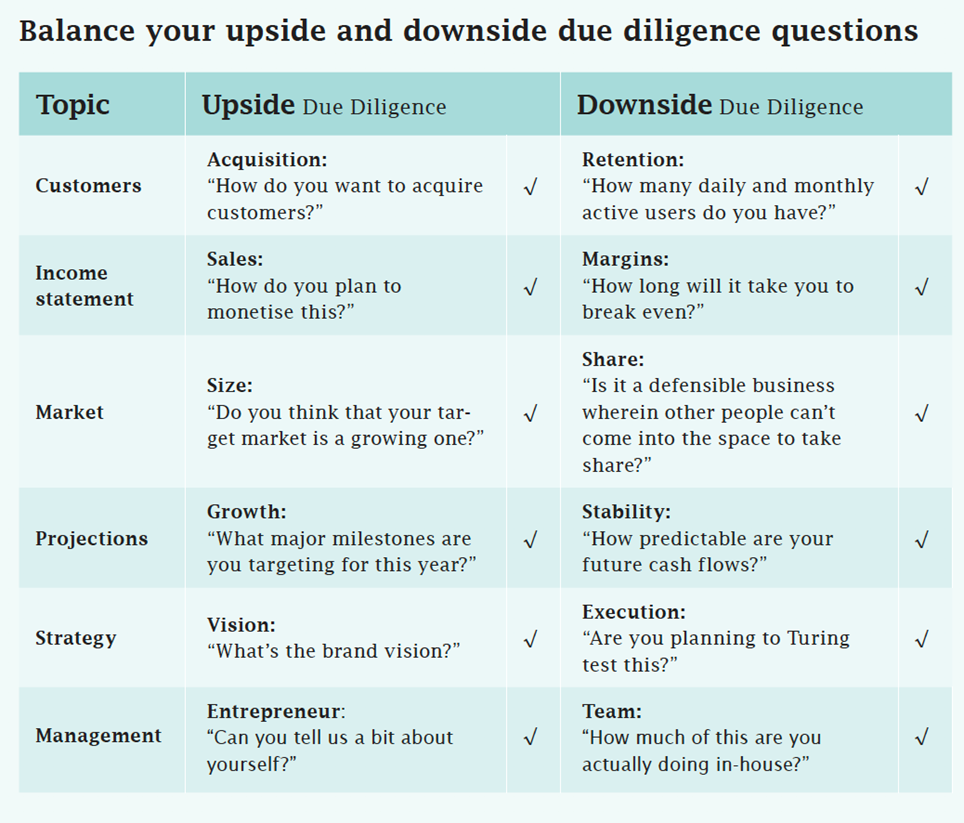

How to counter it: Try to keep track of how you weigh your questions during your next pitch event – see “Investor Solution #7’: Balance your upside and downside due diligence questions” in previous section.

-

The Confidence = Competence Illusion

The bias: Confidence is often mistaken for competence, perhaps particularly in the world of startups and pitch events, where founders are effectively trying to sell their idea in a very short timespan. This actually exacerbates most biases, and especially it risks setting the founders with the least amount of pyrotechnics – but perhaps more substance – up to fail.

How to counter it: Give founders with smaller arm movements an extra chance. Take a second look at their numbers and the facts, and not just on the storytelling. This is not just about gender, but women are on average more likely to focus on facts and substance than showmanship.

”It’s so important to be aware that biases are there, even though our gut instinct may be to deny it. Bias goes to the bottom of society and the world around us. That is why we need a change in mentality and we need a platform for action.”

– Rolf Kjærgaard, CEO, Vækstfonden

And remember: Balance your upside and downside due diligence questions

Finally, it is important to be aware of the tendency of asking mostly preventive questions to female founders. This tendency can be countered by remembering to complement those questions with more promotive questions – and vice versa for male founders. As an upside, this will give you a more objective understanding of the founders you are evaluating – regardless of gender.

“If we want more women in the startup ecosystem and more female founders, we need a concerted effort towards change and towards levelling the playing field. Not because of charity, but because it will be better business – for startups, for investors and for Denmark.”

– Klavs Hjort, SVP for Growth & Impact in Danske Bank

To keep track of this balance, make a note of two columns of your upside and downside due diligence questions (Kanze, D., Huang, L., Conley, M. A., & Tory, H. E. (April 01, 2018). We ask men to win and women not to lose: Closing the gender gap in startup funding. Academy of Management Journal, 61, 2, 586-614.):

Comments