Article #5 – Impact Investing Report: How do you measure the real impact of your investments?

Investing for impact is not a new category or asset class. Although it’s not yet mainstream among asset managers to invest in impactful entrepreneurs and worthy causes to improve our world, impact investing is already practised by many investors – also in the Nordics. Next step of maturity needed in impact investments in the Nordics – and also globally – is how to manage your impact investments, measure the outcome and show evidence of real change when reporting. In this article we ask Hampus Jakobsson from Pale Blue Dot and Mike McCreless from The Impact Management Project how to navigate in the complex world of impact measurement.

This is no. #5 article in a series about Nordic investments in impact, Bootstrapping are publishing from the Impact Report Nordic Investors 2020 in collaboration with The One Initative. The report is sponsored by +Impact by Danske Bank, Vækstfonden, Novo Nordisk Fonden & Nordic Innovation.

Facts and key figures – Impact Report Nordic Investors 2020

Download a free copy of the report here.

The underlying survey for the analysis was targeted at Nordic and Baltic private equity investors within early stage solutions – primarily business angels, venture capital funds, governmental capital funds, accelerators and family offices. The survey with 51 questions was conducted Q2-Q3 2020 and the report was launched by The One Initiative 9th of December 2020.

WHY INVEST IN IMPACT?

80% think impact investments provide opportunities for a good return.

61% answered that financial returns on impact investments are in line with or outperforming their expectations.

62% answered that their impact portfolio performance is in line with or outperforming held up against the impact expectations.

67% of the investors say that they expect to increase their impact investments.

HOW TO INVEST IN IMPACT?

74% state that they have a longer time horizon when investing in impact.

49% have to be more engaged in their impact investments than traditional investments.

49% see the need for more specialization to invest in impact.

WHAT TO INVEST IN FOR IMPACT?

Nordic investors chose Climate as their preferred theme (20%) followed by AgriFood (14%), Energy (13%) and Health (13%).

40% of investors have 100% of their private equity portfolio in impact investments.

43% of the respondents invest 100% of the private equity impact portfolio in technology.

WHERE DO THEY INVEST FOR IMPACT?

76% of investors invest primarily within Nordics.

Only 16% chose the possibility to have a positive impact as the reason to invest in developed markets.

42% of investors are primarily driven by deal flow and the types of solutions available, when prioritizing a certain market and 11% because of their expertise.

30% of the respondents have chosen impact as the main reason to invest in emerging markets.

Though we can see a desire to invest in climate solutions through the survey respondents, fewer of those actually invest in solutions due to the difficulties of impact measurement.

But according to Hampus Jakobsson, General Partner & co-founder of the Swedish climate VC fund Pale Blue Dot, although measurement is important it shouldn’t be pursued to the point of paralysis. Impact investments should fundamentally resonate with investors and over time they should find the metrics to measure their actual impact:

”A good example is an investment we made in a company that reduces the risk of forest fires. One of our investors asked us to report on the carbon dioxide emissions that are avoided with this technology, i.e. carbon dioxide equivalents.

But how do you measure how many carbon dioxide equivalents a risk minimization company for forest fires reduces in advance? We know that 2% of all CO2 emissions in the world is because of forest fires. And we know that this technology significantly reduces the risk. We feel it is enough for now to measure the number of square kilometers of forest that the technology monitors. When this company have succeeded, raised hundreds of million dollars in additional funding and perhaps are the ones defining this market, then we can expect them to report on the impact they’ve achieved, ie. if they have decreased risk for global forest firest with 10, 20 or even 50%.

One of the basic challenges when investing in climate solutions is the need to combine a scientific mindset with being an investor. On one side you have to be deep into the details and have a critical approach, whilst on the other you have to take risks like you’re playing a game

of Texas hold’em poker. As an investor, you sometimes have to make a bet because there is often no more objective truth. This way of working doesn’t necessarily go well with the scientific approach. It can be like oil and water.”

Hampus Jakobsson

The language of impact is spreading throughout the world

To translate the highlevel aspirations around the world on impact investing to much more detailed concrete practices, supported by data and evidence, we need a common language. The Impact Management Project (IMP) took on that ambition almost four years ago. They are now an acknowledged forum for building global consensus on how to measure and manage impacts.

The Impact Management Project

IMP provides a forum for building global consensus on how to measure, manage and report impacts on sustainability. It is relevant for enterprises and investors who want to manage environmental, social and governance (ESG) risks, as well as those who also want to contribute positively to the UN 17 Sustainable Development Goals.

They convene a practitioner community of over 2,000 organisations in the world to share best practices, delve into technical issues and identify areas where further consensus is required in impact measurement and management.

They also facilitate the IMP Structured Network – a collaboration of 16 standard-setting organisations that, through their specific and complementary expertise, are coordinating efforts to provide complete standards for measurement, management and reporting of impacts on sustainability.

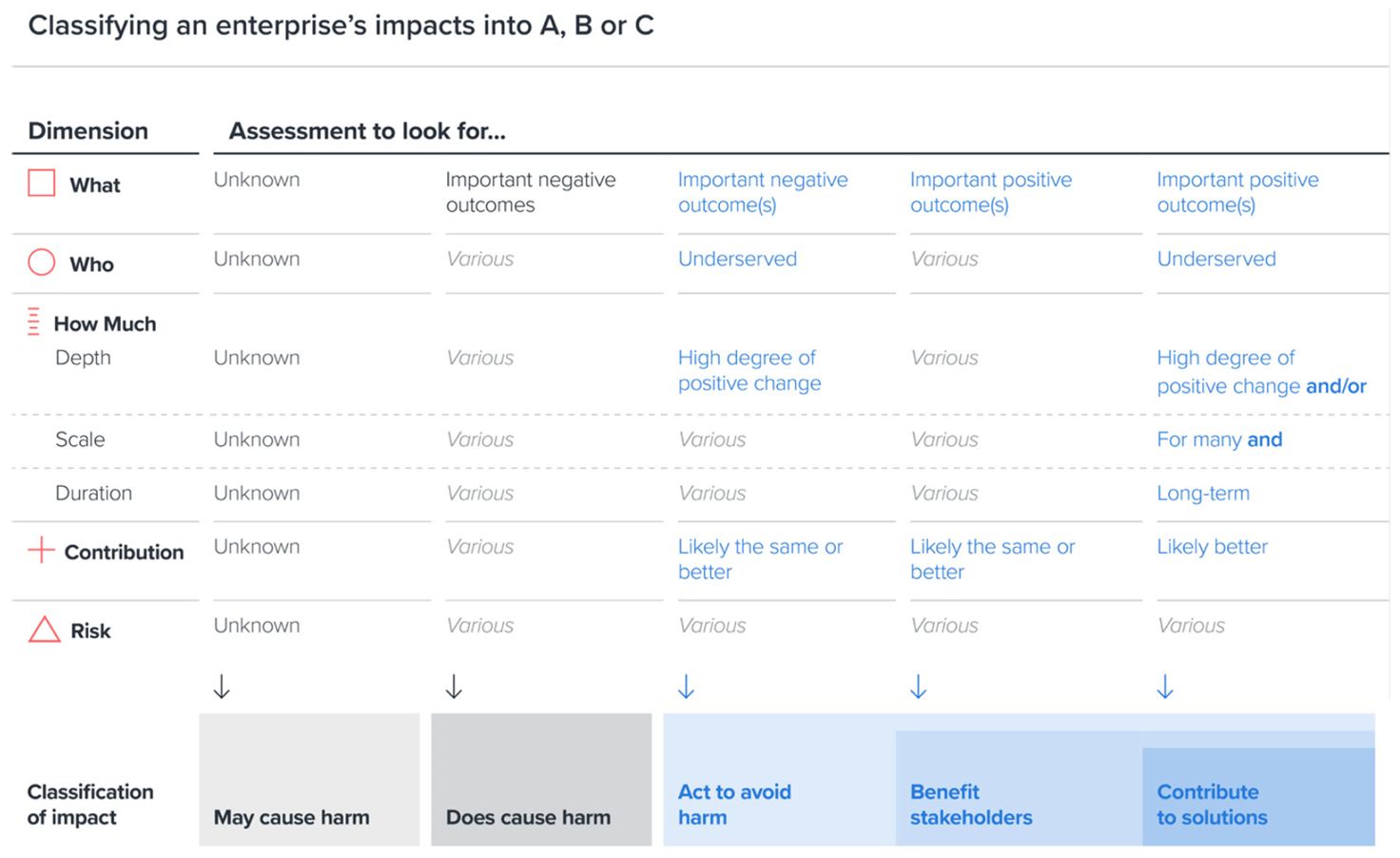

IMP works with three intentions on impact, the ABC’s (Avoid to do harm, Benefit stakeholders and Contribute to solutions). Investors’ intentions across the ABC of impact map to specific impact goals across five dimensions: What, Who, How much, Contribution and Risk. See framework below.

Mike McCreless, the Head of Investor Collaboration at IMP, explains the framework: “You can use the five dimensions in a very practical way and match and combine with other international tools and frameworks. We already have thousands of practitioners of the five dimensions around the world. We see a large uptake all across the spectrum. Small funds in emerging markets, private equity investors and venture capital use it to organize their thinking. Asset managers, investing directly in companies tend to like to use the five dimensions in a way that is customized to their context.

But for asset owners, like pension funds in the Nordics or global capital funds managing huge pools of capital, that level of detail is overwhelming for them. They can’t manage five dimensions across all these assets and sectors, so they need to have a higher level to the portfolio as a whole, which are the ABC’s.”

Mike McCreless

Mike McCreless

We live in a world where many investors don’t consider a positive impact from their daily investments. In some cases, there is a good alignment between a strong positive impact and a good financial return. In some cases, not. Mike McCreless sees that you have to improve the communication between the entrepreneur, the asset manager (e.g., a VC fund) and the asset owner (LPs), so they have confidence that the impact intentions are met with the right capital. Mike underlines that it is an ongoing challenge. He sees a good movement but doesn’t think we’re there yet:

“I saw in your Impact Report Nordic Investors 2019 that there is this interest in understanding if you have to trade off financial return to achieve impact. Respondents said they believe they have positive impact along with financial return. But then in another part of the report you show that there are few in the Nordics actually measuring the impact. This is really common. It’s actually the situation in the whole world. It is obviously not that simple as if every time you increase impact you also improve your profitability, nor is it always the opposite! The world is more complicated, and more interesting, than that.”

Mike McCreless finally points out that the five dimensions provide a practicable way to develop and test more detailed and nuanced hypotheses about the relationships between impact and financial risk and return, using data to see that impact is not just one big homogenous entity that has one universal relationship with financial return. You have to see in which context a type of impact actually does improve financial performance and get that straight. And also, what type of impact doesn’t have any relationship either way to expect profit.

He concludes: “IMP is a little like grammar in a language. It’s not a vocabulary, but each sentence should have a subject, a noun and a verb to function. I see each approach to impact should somehow cover these five dimensions.”

Comments