Article #4 – Impact Investing Report: Personal motivation is a key driver for impact investing

Frankly speaking: is impact investing really about doing well? Or just about doing good? In this article, based on ‘Impact Report Nordic Investors 2020’, we look at what impact investors themselves say is their core motivation for their work, and we examine the qualities they believe are necessary to succeed as investors. Finally, experienced impact investor, Mette Fløe Nielsen, tells us that you should always remember that impact investing is not about you as investor, it’s about the company you invest in.

This is no. #4 article in a series about Nordic investments in impact, Bootstrapping are publishing from the Impact Report: Nordic Investors 2020 in collaboration with The One Initative. The report is sponsored by +Impact by Danske Bank, Vækstfonden, Novo Nordisk Fonden & Nordic Innovation.

Facts and key figures – Impact Report Nordic Investors 2020

Download a free copy of the report here.

The underlying survey for the analysis was targeted at Nordic and Baltic private equity investors within early stage solutions – primarily business angels, venture capital funds, governmental capital funds, accelerators and family offices. The survey with 51 questions was conducted Q2-Q3 2020 and the report was launched by The One Initiative 9th of December 2020.

WHY INVEST IN IMPACT?

80% think impact investments provide opportunities for a good return.

61% answered that financial returns on impact investments are in line with or outperforming their expectations.

62% answered that their impact portfolio performance is in line with or outperforming held up against the impact expectations.

67% of the investors say that they expect to increase their impact investments.

HOW TO INVEST IN IMPACT?

74% state that they have a longer time horizon when investing in impact.

49% have to be more engaged in their impact investments than traditional investments.

49% see the need for more specialization to invest in impact.

WHAT TO INVEST IN FOR IMPACT?

Nordic investors chose Climate as their preferred theme (20%) followed by AgriFood (14%), Energy (13%) and Health (13%).

40% of investors have 100% of their private equity portfolio in impact investments.

43% of the respondents invest 100% of the private equity impact portfolio in technology.

WHERE DO THEY INVEST FOR IMPACT?

76% of investors invest primarily within Nordics.

Only 16% chose the possibility to have a positive impact as the reason to invest in developed markets.

42% of investors are primarily driven by deal flow and the types of solutions available, when prioritizing a certain market and 11% because of their expertise.

30% of the respondents have chosen impact as the main reason to invest in emerging markets.

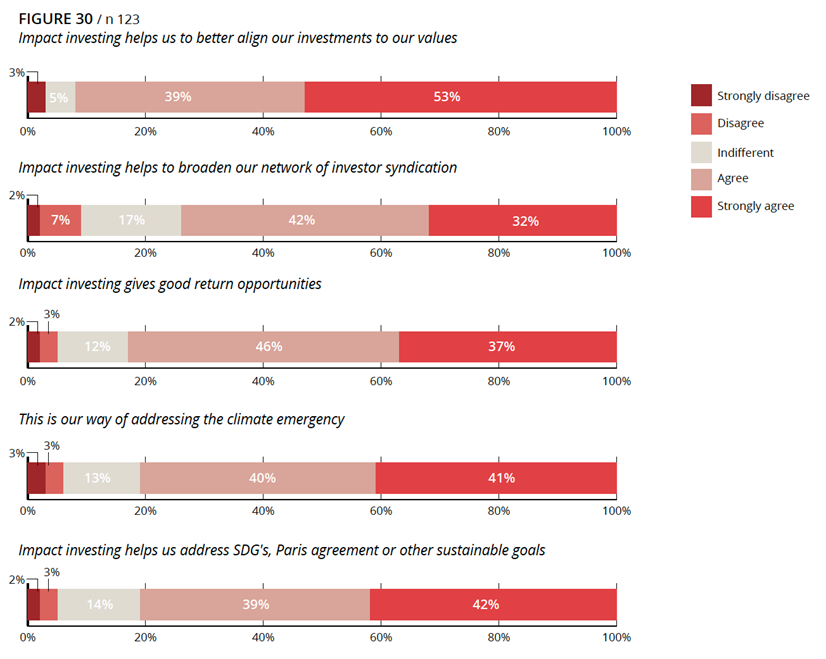

Before embarking on a new business venture, any investor will spend time considering what they will gain if they decide to invest for a positive impact. Figure 30 from the report shows that a large majority believes that impact aligns investments to their personal values, meaning that investments made are in line with the values which individual investors follow.

Figure 30 also tells us, that almost as many investors state, impact investments help expand their network, which is also in line with the profile of the respondents who often make investments in collaborations with others. Many also respond that impact investing helps them contribute to the fight for a better climate and to help address the SDGs.

Finally, around 80% answer that impact investments provide opportunities for a good return, which emphasizes that a majority have the intention to contribute to sustainability alongside a financial return.

Are impact investors more committed?

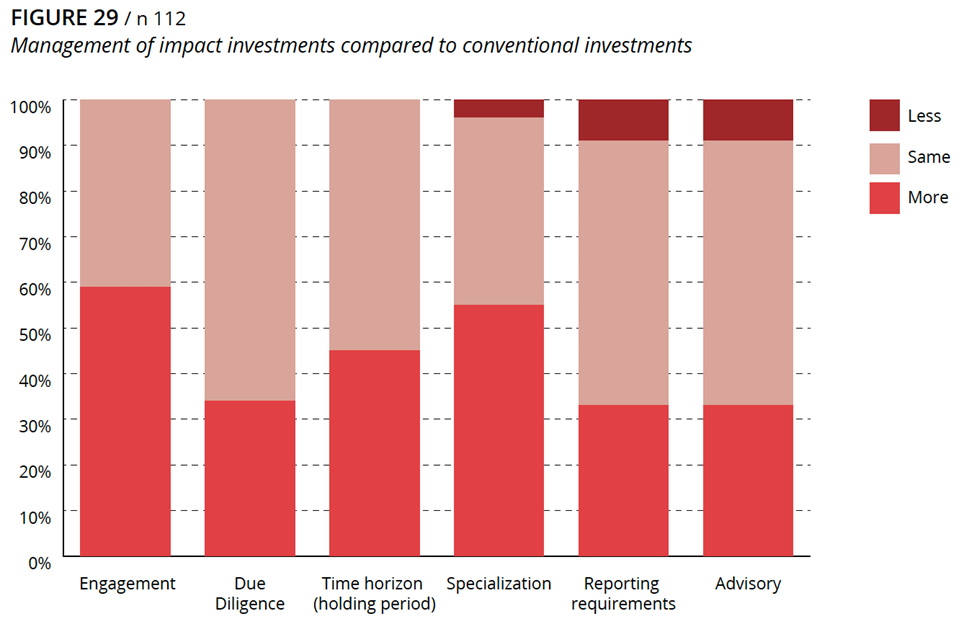

In the report, we further explored how respondents’ impact investments differ from their more traditional investments. As a result we uncovered some significant findings (figure 29). First and foremost, we uncovered a need to be more engaged when investing in impact. More than a half (59%) stated that they have to be more engaged in their impact investments than traditional investments, while the rest answered the same level of engagement. The increased demand for engagement in impact investments is probably explained by the fact that many impact investments in the Nordics are still in early stage solutions.

Another significant finding is represented in the time horizon. 45% percent stated that they have a longer time horizon. As impact investments often are characterized by new inventions on complex problems, this corresponds well to expectations. The respondents also stated that impact investing to a greater extent requires specialization, more time and effort in the due diligence process and also more advisory services.

The expected returns on impact investments look solid!

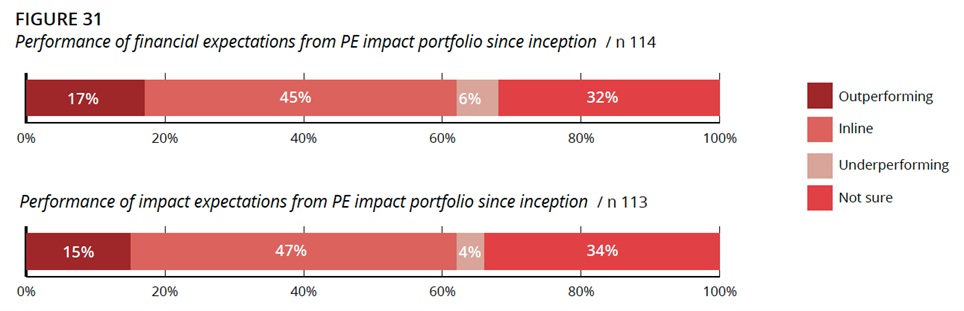

Further more, we explored how impact investment have been performing overall. Almost half of the respondents (figure 31) answered that financial returns on impact investments are in line with their expectations. Nearly a third were unsure which could maybe be due to lack of a baseline for impact investments. Nonetheless a large proportion believe that their impact investments have performed well – or even outperformed the expectations.

Answers were homogenous across the board, when we asked how the private equity impact portfolio performed overall since inception and whether it held up against impact expectations (figure 31).

Mette Fløe Nielsen: Investors should give as much of themselves as the investment requires – but not more!

As impact investor, there is an opportunity to live out the ambitions that lie deep within oneself. Together with like-minded people, impact investors can use their capital to create a better tomorrow. But you should not get involved for your own sake only to the extent that it helps your investment, says angel investor Mette Fløe Nielsen.

Mette Fløe Nielsen

The vast majority of people get involved in impact investing for obvious reasons – to make an impact. Whether it is to mitigate the climate crisis, prevent food waste, or provide better education worldwide, the idea of doing business whilst doing good is deeply compelling.

Whilst it is deeply satisfying to work as an impact investor, it should not be done to please oneself. Ultimately, it’s always about what’s best for the investment, as is argued by Mette Fløe Nielsen, CEO of M.I.L. Invest, business advisor and angel investor:

”There is no difference between an impact or a traditional investment when it comes to the level of involvement. You have to be as committed as the business requires, and you always have to remember that you are not there for yourself.”

With a background in IT and with various management positions in large companies, Mette has significant experience in the startup ecosystem. At the same time, her husband was an IT entrepreneur, so they were an entrepreneurial family and have always had a great knowledge of the startup environment. When Sitecore, one of their companies was acquired, it released enough capital for them to go into private equity investing.

For Mette Fløe Nielsen it quickly became clear that investing in startup and scaleup companies requires a strong network with whom one can co–invest. As a result the Nordic Makers was formed, a group consisting of peers within the investment world focusing on technology-driven investments. For Mette, however, some investment opportunities attracted particular attention:

”I viewed pitches on a constant basis, but it was always the same kind of ones that attracted extra attention. These were the startups where the business was more than just the product or service. I liked it best when the impact angle was central to the business model.”

As a result , she decided to focus exclusively on businesses whose core model was based on impact-driven technology. Her strategy became increasingly defined over five years, allowing her to select startups that where either SDG focussed or the ones closest to her heart. She chose the latter.

”For me, the focus became increasingly about the climate. I have children and I want them to have a planet worth living on in the future. Furthermore, the climate angle was something tangible for me. The changes are obvious because we have not really had a white Christmas since I was a child.

Within the climate agenda, I focus primarily on energy sources – preferably with the “odd man out” angle such as alternative sources of energy for the future. The other area that interests me the most is social impact. We do not have that much inequality in our part of the world, but in most other places it’s a huge problem. It’s frustrating that we don’t talk about that as much as we talk about the climate. We must not forget that due to our political and social infrastructure in the Nordics, we are well-placed to come up with ideas and new technologies for social problems. We are privileged to know a lot about how to build an equal society.”

Though many in our survey stated that patience is an important trait as an impact investor, Mette suggests that it depends significantly on the investment.

”If you throw yourself into a research-based investment, it takes longer before you get a return. This doesn’t change whether it’s an impact or a traditional investment. If the product is fully developed and the market strategy is ready, you can create a return in record time and have an instant impact. Just look under the Covid-19 lockdown. Several companies have had an excellent product-market-fit, and therefore have been able to create a large turnover.”

When it comes to long lasting impact, Mette looks forward to many of the investments being made today materializing in the years to come. She concludes: ”We are missing the results. As we did 20 years ago when we started to talk about tech. We’re missing some superstars. But they will come soon – no doubt!”

Comments