#2 Silicon Valley Going Green: Is Corporate America Going Green?

How is Corporate America adapting to a reality where global warming has become more dominant in the minds of consumers and other key interest player? This week’s ‘Going Green’ article is examining the potential switch from shareholder primacy to shareholder activism and who the key players in America are.

In the latest letter from CEO and Chairman of Blackrock, Larry Fink, he asks the companies they invest in for a business model that is compatible with a net zero economy and that the strategy to realize this is incorporated into the long-term strategy. Also, he urges the companies to move quickly to issue the relevant disclosures rather than waiting for regulators to impose them.

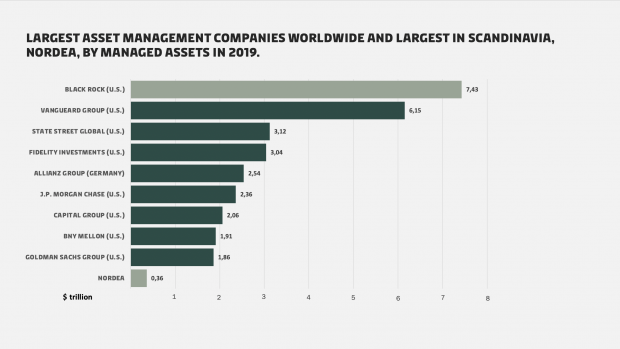

As the largest asset manager in the world, Blackrock plays a defining role for the asset management industry and the companies they invest in. And they do this with an enormous power. To put the size of Blackrock into perspective, its assets under management is by comparison more than 20 times larger than the GDP of Denmark.

In Europe, the overarching Green Deal acts as a strong incentive for corporations to embark on a green transition. In the US, such a united government policy framework is absent. But US businesses, not least in California, are still moving towards a greener future, and key drivers can be found in the private sector. In the context of business and investors, the subject of climate change is often treated as part of broader range of issues referred to as ESG (Environment, Social and Governance). While the direction of the green transition is similar to what is seen in Europe, the challenge of securing a financial system that supports a move towards a sustainable future is addressed differently.

A Slow Movement Away From Shareholder Primacy

Corporate governance in the United States has long rested on the principle of shareholder primacy inspired by Nobel prize-winning economist Milton Friedman. Friedman argued that executives work for the owners (shareholders) and the only social responsibility of a business is “to use its resources and engage in activities designed to increase its profits”. Following this principle, corporations have been led to primarily focus on short-term quarterly returns to the benefit of shareholders.

It was therefore noteworthy when the business association of American CEOs, Business Roundtable, in 2019 issued a statement outlining a new purpose for corporations, moving away from shareholder primacy. Instead of primarily serving stakeholders by maximizing profits, this new purpose widens the scope to include all stakeholders.

”Each of our stakeholders is essential. We commit to deliver value to all of them, for the future success of our companies, our communities and our country.” – Business Roundtable

The signalled shift is significant. But in the United States, often associated with a strong belief in capitalism and wealth creation, it does not represent a fundamental and overnight change of the corporate mission. For instance, Warren Buffett, also known as “The Sage from Omaha,” has voiced skepticism of the role of corporations in “imposing their views on doing good” on society. He will only invest in climate-friendly technologies when they make good business sense. As the most successful investor in the United States and the fourth-richest man in the world, Buffett is a leading voice of corporate America. Nonetheless, there is an acknowledgement that companies must consider the interests and expectations of a range of stakeholders for the sake of securing long term returns to shareholders.

The World’s leading Shareholder Advocate

As You Sow was founded in 1992 to promote environmental and social corporate responsibility through shareholder advocacy, coalition building and innovative legal strategies. In August of 2020, they were declared the #1 Top Corporate Watchdog by Ethos.com. As You Sow are attempting to make corporations understand the broader risk of only focusing on short-term results. They collaborate with businesses to develop policies and practices that bring about positive environmental and social change. At the moment, As You Sow is monitoring how asset managers such as Blackrock implement the Business Roundtable’s new corporate approach of including all stakeholders.

Groups of shareholders are also becoming more active. Climate Action 100+ is an investor group that pushes for the world’s largest corporate greenhouse gas emitters to take swifter action to combat climate change. Members include corporate giants such as BlackRock and a new kid on the block is the San Francisco-based investment firm Engine No. 1 LLC, which was launched on December 1st 2020 by the experienced hedge fund investor Chris James. Engine No. 1 LLC has immediately made headlines by going after the energy company Exxon, pressuring the company to remake itself and focus more on clean energy.

While Engine No. 1 only has small shares in Exxon, it has teamed up with the California State Teachers’ Retirement System (Calstrs), which holds a more than $300 million Exxon stake. Another example of shareholder advocacy is California-based As You Sow, one of the world’s leading shareholder advocates, which has a specific focus on climate

How does shareholder activism work in the real world?

Watch the video to hear Lisa Goldberg and Austin Wilson from Aperio explain the logic behind Shareholder Activism and give some examples from the real world.

Stakeholder Activism Is on the Rise

The term ‘lobbying’ originates from the United States, and the role of activists in the US is noteworthy. The gaining momentum of stakeholder activism is part and parcel of the changing business landscape. Corporate “stakeholders” are parties with interest in the company, such as investors, employees, customers and suppliers. Underpinning the stakeholder focus is the belief that businesses are not only accountable to their owners, but also to society.

“We’re a net zero company because Climate is a stakeholder” – Mark Benioff, CEO, Salesforce

”You will spend 80,000 – 90,000 hours working in your life. That is the singular biggest investment you are going to make ever. So, make that investment count.” – Katie Cech, ClimateVoice team member

Besides investors, a key stakeholder for companies is their employees, and companies with many younger employees are experiencing pressure to move faster in a green direction. Last year, for example, Amazon employees walked out of offices in Seattle, Los Angeles, San Francisco and other cities to take part in a “climate strike” as the first-of-its-kind labour dispute. It had an effect. A week later, the company pledged to buy 100,000 electric-powered delivery trucks, reveal its annual carbon emissions, spend $100 million on reforestation and convert to 100% renewable energy by 2030.

The activist organization ClimateVoice is attempting to harness this stakeholder power held by employees. The organization is led by CEO Bill Weihl, a former Facebook Sustainability VP. Besides pressuring individual companies, ClimateVoice is leveraging the voices of employees to push companies to support specific climate legislation.

ClimateVoice

ClimateVoice’s mission is to build a movement by empowering employees to step up and push their companies on climate policies, both in business practices and policy advocacy. By signing ClimateVoice’s pledge, employees commit to endeavor to choose a workplace that is pro-climate, and in general go #allinOnClimate.

Employees are encouraged to urge companies to go all in on climate and support policies at the local, state and national levels that are focused on driving rapid decarbonization. The CEO of ClimateVoice, Bill Weihl frames the need for ClimateVoice this way:

“We need companies to be really ambitious in what they’re doing in their operations. And we need employees to push them to be more ambitious in that work.”

Corporations Are Focusing on How to Report Sustainability

In spite of shifting perspectives, investors remain the primary stakeholders. But, as Larry Fink’s open letter demonstrates, investors are increasingly aware of the imperatives of managing, measuring and reporting on ESG matters, including climate risk. This has resulted in new demands for standardized quantitative data on sustainability. For corporate America to succeed in going green, there is a need to agree about how to measure it.

Historically, much ESG reporting from companies has been purely qualitative and investors have had to rely on sustainability ratings when analyzing how how companies perform on the ESG agenda. However, there are examples of instances where ratings from different providers disagree dramatically about the same companies.

”We are going to change the course of investments with better disclosures … It is our belief that the best standard to do this is SASB … The faster we have a global standard, the better society will be and more change will occur.” – Larry Fink, Chairman of BlackRock

With solid ESG disclosures directly from the corporation, the data driven investors can make better decisions and unfold their respective stewardship models. Standardized ESG disclosures based on agreed-upon frameworks are also necessary in order to avoid capital flowing into investments that are not truly green. Currently, many investors are frustrated by what they perceive to be greenwashing by corporate boards, according to an annual survey undertaken by asset management giant Schroders.

While the EU is leading when it comes to the regulatory side of reporting on ESG, US organizations such as Blackrock are moving quickly ahead on on requesting specific specific standardized disclosures based on SASB without waiting for regulation.

The CEO and chairman of Blackrock, Larry Fink is referring to The Sustainability Accounting Standards Board (SASB), which aims to provide a complete set of globally applicable industry-specific standards, thereby creating a unified system.

SASB

The field of organizations working with ESG data is immense. However, it is still a developing field. Generally speaking, all organizations seem to be in agreement about the need to move towards a more unified system. San Francisco-based SASB appears to be at the centre of this move. The organization has the support of many US-based organization such as Blackrock, but a growing number of large Danish organizations such as Nordea and Danske Bank are also supporting SASB.

“I am sure that Europe can learn a lot from SASB and maybe vice versa” – Susanne Stormer, Sustainability Advisor, Novo Nordisk, December 2020

SASB’s mission is to facilitate communication between companies and investors by giving them decision-useful information. This information includes specific disclosure standards across financial, material, environmental, social and governance topics. Companies adhering to the SASB standard will disclose industry-specific metrics, which will enable investors to understand how companies are managing various ESG subjects including climate. The SASB Foundation is an independent non-profit organization, and it operates in a governance structure similar to other internationally recognized bodies that set standards for disclosure to investors, including the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB).

One step towards a unified system was announced in December 2020, when SASB and the International Integrated Reporting Council (IIRC) announced a merger and the creation of the Value Reporting Foundation. Prior to the merger, a group of five sustainability reporting organizations, including SASB and IIRC, joined forces and said they plan to work together to develop a comprehensive global corporate reporting system.

Corporate America is Slowly Going Green

An increasing number of American corporations are also formulating climate goals. According to the California-based business platform Greenbiz, more than 1,000 companies, with a combined market cap of $15.4 trillion, have committed to setting science-based targets for reducing emissions in line with the Paris goals. Furthermore, close to 300 of those signatories have pledged to act according to the Business Ambition for 1.5 Degrees campaign, which includes a target to reach net-zero emissions by no later than 2050.

Tech companies’ potential platform

Globally, the IT sector has a significant responsibility to combat climate change. First, the sector not only has to deal with its own emissions—in Denmark it is predicted to be responsible for 17% of the Danish energy consumption in 2030—but moreover, it is an important enabler for climate tech solutions for companies in other sectors. Salesforce, known for CRM SaaS tools, with a market capitalization of $0.21T, is an excellent example of how Silicon Valley’s IT giants is approaching climate action and the business opportunities that come with increasing climate awareness.

Salesforce’s CEO/Founder, Mark Benioff, is a strong believer in stakeholder capitalism and known for catchy statements such as “Business is the greatest platform for change.” Benioff has managed to combine profits with climate leadership and has been called an industry trailblazer.An example of Salesforce’s successful climate leadership is the development and launch of the “Climate Cloud” solution, which enables companies to track, analyse and report reliable environmental data. Salesforce is also leading on reporting on sustainability with quantitative standardized measurements.

When Larry Fink, CEO and Chairman of Blackrock, says that “climate transition presents a historic investment opportunity” America listens. Investors and corporate America is increasingly heeding the global climate call as ESG stakeholders and activists are joining consumers in demanding sustainable and long-term viable business models. If global perspectives regarding the transitioning our economy and companies to Green and ESG Leadership is relevant for your organization, for example in terms of management training, talent development or similar programs, please contact us to discuss partnership opportunities.

This article was written by The Innovation Centre Denmark in Silicon Valley and is brought to you as a part of the ‘Silicon Valley Going Green’ series in collaboration with the Innovation Centre.

Comments