Return on Diversity #7 – Calling all investors: Are you missing 50% of the product-market fit?

In 2019, 90% of Danish Business Angels were male. Such a strong predominance of one gender may lead investors to miss out on market potential targeting female customers. Why; because often they have no personal experience within the field. And if a startup is seen as trying to create a completely new market, or enter an unknown one, it can seem more unsure and risky, and e.g. angel investors may be unsure of what they can bring to the table.

This is no. #6 article in a series about the lack of gender balance within the Danish startup eco system, Bootstrapping are publishing from our guide Return on Diversity. The guide is a collaboration between Bootstrapping, Female Founders of the Future and Nextwork sponsored by Danske Bank and ITB, and supported by Vækstfonden and Danish Business Angels. It’s mission; to provide tools and guidelines for founders, investors and for those who organise investments, on how to help fix the gender imbalance in the Danish startup ecosystem.

The best ideas prevail – if you’re a man

The traditional – maybe even old school – view in the market economy is that the best suited – or fittest – companies will prevail in free competition with each other. In the startup economy this could be translated into the assumption that the best ideas and teams will receive funding and the free market forces will do the rest.

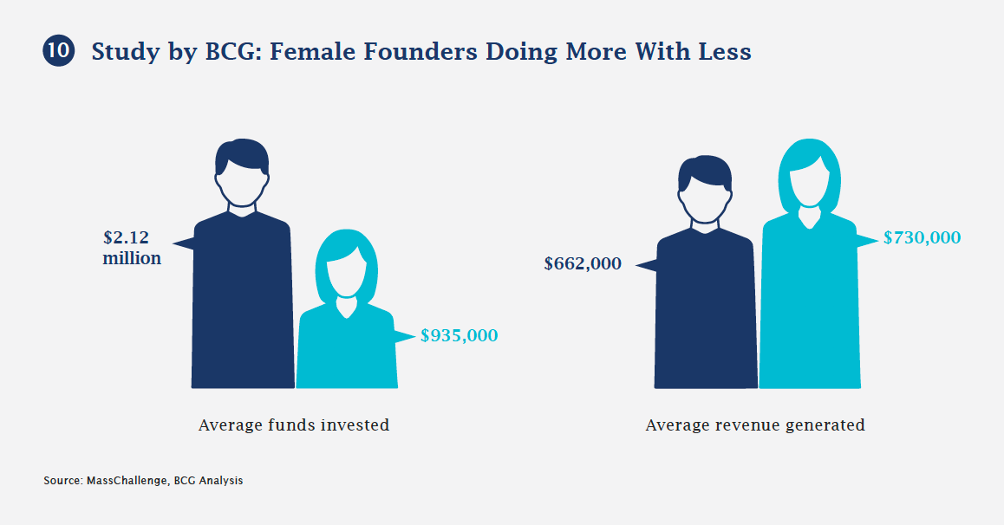

However, that is rarely the case for the best ideas of women. An illustrative example of this is a study by BCG that found that male only-teams on average raised 2,21 million dollars compared to 935,000 dollars for teams with at least one female founder. This is in spite of the fact that startups with at least one female founder, generated on average 68.000 dollars more than male only-teams. (Source: Why Women-Owned Startups Are a Better Bet, Boston Consultant Group 2018).

So teams with women do better, in spite of having fewer financial means to do so.

Products, services and tech-solution targeted women, are seen as “niche”

Startups often solve problems that the founders have experienced themselves. Women meet other problems than men. And this has the makings of a problematic cocktail, if the startup has been founded by a woman, who has created a service or product targeted at other women or solving a “female” problem.

This is an experience Gulnaz Khusainova, founder and CEO of Easysize, has seen many times:

“When a female founder is building a startup in a market that is considered “a female niche” – e.g. catering to and solving needs of women – she is often overlooked by (male) investors. They often look at it as a limited market opportunity, a problem that only a few experience and have. Even if the founder has numbers and metrics to back her story up, she is still dismissed because male investors cannot relate”.

Be sure to read about Gulnaz’ Easysize in our weekly startup case here.

What could make men avoid investing in the problems of women?

Many male investors may have implicit or explicit blindspots for startups that are targeted women.

Why?

» Men are not personally exposed to the problem solved by the startup

It is harder to intuitively judge the size of the problem and the potential of the solution, because the investor has no immediate experience with the problem.

» Investors are unsure, of what they can bring to the table

Business angels typically bring much more to the startup table than money. They also provide priceless value in the form of advice, network and experience. If the investor lacks knowledge or experience with the product’s world, sector or target group, they may feel like they couldn’t give the support needed to the entrepreneur.

» If it is seen as a new market, it can seem more unsure and risky

This is a vicious cycle, that will only be broken if the investor starts making the first good investment in this “new” market. The good news: It seems to be an underserved market with a huge potential upside.

Femtech – an untapped market potential?

An example is Femtech, a term coined in 2016 by Ida Tin who founded Clue, a period- and fertility-tracking app. As an industry, femtech largely encompasses any digital or standard health tools aimed at women’s health, including wearables, internet connected medical devices, mobile apps, hygiene products, and others.

Frost & Sullivan Market Research report on Femtech states that the market is under-penetrated but has the potential to reach $9.4 billion by 2024. This is just one out of many industries, that is related to problems women experience that are in need of solutions made by entrepreneurs. It seems that even though roughly half of the world’s population is female, solutions targeted at women still present an untapped potential.

Potential: Make sure you look beyond your own immediate knowledge

Selection boards play a key role in deciding which startups can move from just a pitch deck in a pile to who actually gets to present for investors. Making sure you have a selection board that is fit for judging diverse startups and founders, is therefore the first step in helping attain diversity – e.g. gender balance – and the premise for better investment decisions down the line.

“A couple of years ago, when we just started out in byFounders, we had an all-male team, and you could say our outlook was a bit blindsided. When we recruited our first female employee our perspective started to broaden both internally and externally. Being too similar in your backgrounds simply narrows your perspective and insight.”

– Tommy Andersen, managing director byFounders

Problem: We deselect the unknown

We are all biased. These biases affect our decision making every single day, and can be a hindrance to making balanced investment decisions. One bias is our tendency to find what we do not know more risky or less attractive. Leading investors to select startup cases that have the fewest “unknowns”, and most “knowns”. However startups with unknown qualities or quantities, can also be great investments, and should not be discarded out of hand.

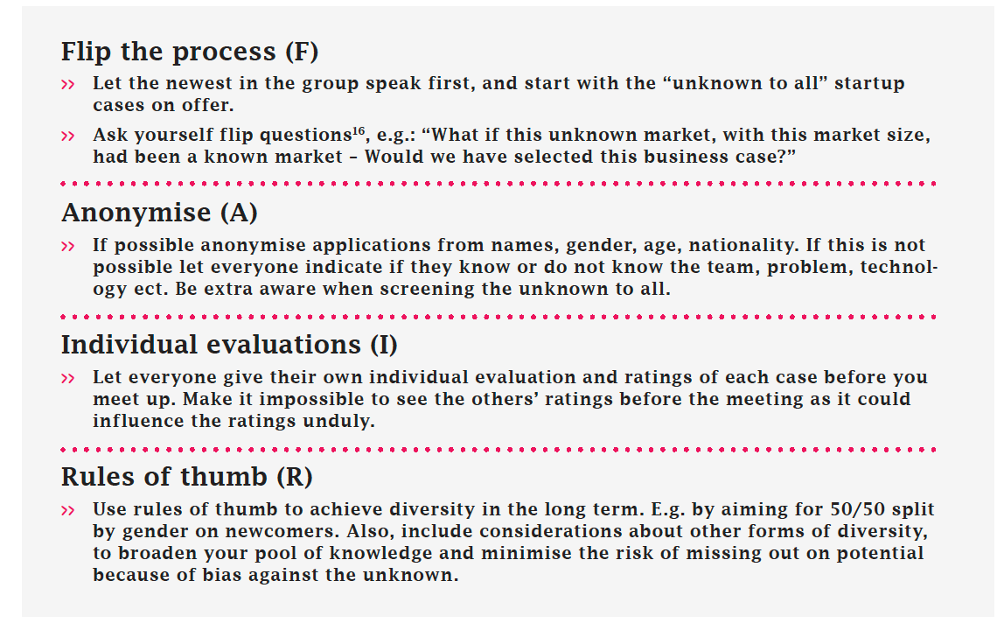

Solution: FAIR – 4 steps towards a more diverse selection process

A few design hacks can support you in minimizing biased decision making. Although the FAIR framework is primarily aimed at the decision process of selection boards, any investor can at least apply the first advice, namely to “Flip the Process”.

Comments