…as we explore throughout ’Return on Diversity’, when it comes to capital, not only are women less likely to receive funding for their startup than men, they also receive less capital on average than men, when they do get funding. The performance data, however, speaks for itself. Startups with at least one female founder seem to match or even outperform male founder teams. In other words: The business case is strong for you as an investor to start diversifying your deal flow and your portfolio.

This is no. #5 article in a series about the lack of gender balance within the Danish startup eco system, Bootstrapping are publishing from our guide Return on Diversity. The guide is a collaboration between Bootstrapping, Female Founders of the Future and Nextwork sponsored by Danske Bank and ITB, and supported by Vækstfonden and Danish Business Angels. It’s mission; to provide tools and guidelines for founders, investors and for those who organise investments, on how to help fix the gender imbalance in the Danish startup ecosystem.

Potential: Get access to overlooked potential

In part 1 of ‘Return on Diversity’, we estimate that approximately 20% of Danish startups have a female founder, however only about 4% of the VC funding go to teams with mixed teams and a measly 1% to all female founder teams – indicating a large and untapped potential. Furthermore, numerous studies (see part 1 of the guide) indicate that female entrepreneurs match or even outperform their male counterparts – showing a clear business case for making an effort to invite and invest in more female founders.

Problem: Overrelying on existing network and assumptions

Male founders tend to have a better network readily available to them, and female founders receive fewer warm introductions to investors than men. Since deal sourcing often is highly dependent on the network, this can easily lead investors to believe that the relevant female founders simply are not out there. However, with an investment-gap of around 15%, that does not seem to tell the entire story. Part of the problem could be that if startups with female founders are not a part of your network, there is a high risk that you will never know about them.

Head of Private Banking in Danske Bank, Bente Nielsen, sees this as a missed potential for both startups and investors:

”There is a bias in the amount of venture capital that accrues to startups with a female founding team. This, of course, has crucial implications for those startups that cannot find the capital for their growth. And for investors who miss out on a good investment. Numerous studies show that diversity drives performance.”

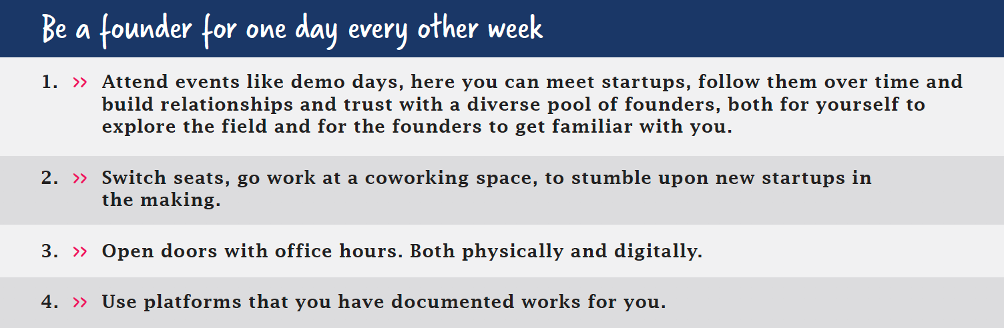

Solution # 1: Looking beyond your immediate network

Diverse talent is out there. But, if startups with female founders are not finding you currently – how can you find them? We suggest actively looking outside your own network to source startups. Why? Because you risk missing out on the business potential of the startups that are not part of your current professional network.

We suggest the following ideas for increasing the number of diverse candidates:

Solution # 3 Be transparent about your deal flow

Make sure everyone can get in contact with you and apply for investment or funding, to avoid the missed potential of relying only on warm introductions. Be open about your search and screening criteria, to ensure that it is clear that you are looking for diverse teams.

You could even go as far as Fast Forward, an American accelerator and investment company, and publish your pipeline of companies:

“We published our pipeline. As soon as we opened up our process, we were flooded with pitches from founders who were not connected to any of our peer investors.”

– Shannon Farley, Co-Founder & Executive director of Fast Forward

Potential: Invest in startups other investors are overlooking

Since female founders tend to perform at least as well as male founders, but receive much less funding, investors might not be tapping into anything near the full potential in Denmark. While others are still sitting on the sidelines, you can take the opportunity to jump onto the playing field and diversify your portfolio – with regards to gender, as well as fields or industries.

Problem : Unintended homogeneity of the founders in an investment portfolio

As stated throughout this guide, there seems to be a funding gap in Denmark between men and women. Now it’s time to ask yourself: “What is the current percentage of female founders in my own portfolio?” If your portfolio reflects the statistic, that number is probably pretty low!

In the VC byFounders, the managing partner Tommy Andersen tells us how measuring can be the first step towards progress:

“What can be measured, can be changed. When we started tracking and reporting on our progress, we also created a focus and a momentum for action. Now diversity and gender balance are recurring items on our bi-annual board meetings. In that way we keep ourselves to our promises.”

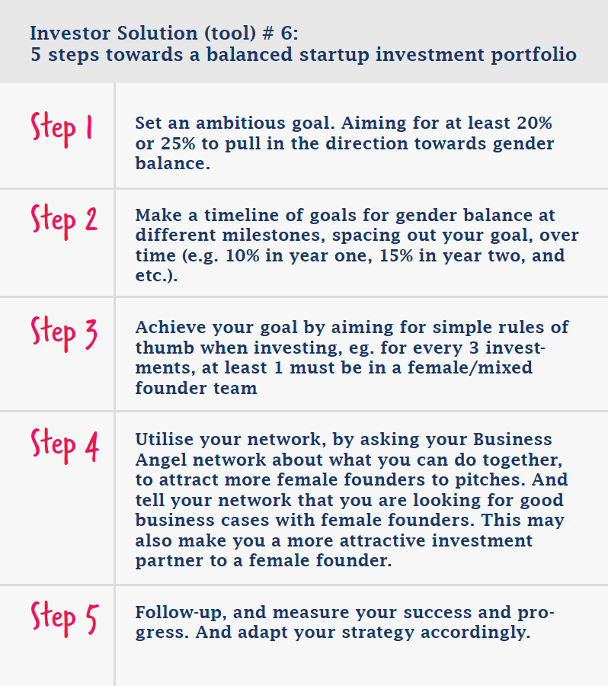

Solution: 5 steps towards a balanced startup investment portfolio

Investors who want a more balanced portfolio could start by aiming for 20% – or 25% or even higher if you want to really drive change in this area.

If you find that your ratio is lower than you would like for your portfolio in the future, we suggest taking the following steps: