This is no. #2 article in Bootstrappings series about the lack of gender balance within the Danish startup ecosystem, as warmup for the launch of the guide Return on Diversity on November 19th. The guide is a collaboration between Bootstrapping, Female Founders of the Future and Nextwork sponsored by Danske Bank and ITB. It’s mission; to provide tools and guidelines for founders, investors and for those who organise investments, on how to help fix the gender imbalance in the Danish startup ecosystem.

Men investing in men, investing in men…

The startup ecosystem has historically been male dominated, and the same can be said about the financial sector more generally:

Most of the investors in Denmark are men. This is the case among business angels, private funds and VC-funds. Only 14% of the Danish business angels in 2018 were women. 74% of American VC-companies have no female investors, and also in Denmark VC-funds are dominated by men. This may be one of the central explanations as to why so few funds go to teams with at least one female founder as documented in last week’s article.

“It’s about daring to knock on the doors of 45 men, who sit in their suits drinking their Barolos and saying: For Christ sake, invite me in. It can be a little intimidating. But just the fact that someone like Birgit Aaby has become a Business Angel is important, because she invests more in women, than a man would perhaps do.

– Le Gammeltoft, founder & CEO, Heartbeats

Why is a predominance of male investors a problem?

The predominance of male investors can help explain the gender imbalance in the Danish startup ecosystem, for at least two reasons:

- The so-called “Hewey, Dewey and Louie”-effect: When investors invest in founders who look like them, like the identical triplets from Duckburg

The Hewey, Dewey and Louie-effect – a term coined by CBS professor Majken Shcultz – happens when men e.g. hire or promote other men, because they look like them or they like them. In the investment world, this could translate into men investing in a younger version of themselves. In turn, this can result in an unintended, implicit pattern of not investing in female founders.

- Historically many successful investors have been men. That can distort data and influence the investor decision making process

It seems reasonable to invest in people that are similar to other people who have had success in the past. Historically, entrepreneurs in Denmark have mostly been men, and so it follows that most successful entrepreneurs in Denmark, have also been mostly men. Since early stage investments are high risk, investors often look for patterns from earlier successes. However this can create a self-fulfilling prophecy, where men continuously are granted a better starting point for success, keeping the stereotype alive.

“To a higher degree, we see women take the leap into entrepreneurship, have success, get on boards etc., and I believe that will impact investments in women”.

– Le Gammeltoft, founder & CEO, Heartbeats

Assessing women and men differently

But… it seems that the playing field is tilted against women in more than one way!

Unconscious preference for a male pitch

A study by Cambridge University found that investors have an unconscious bias for pitches from men rather than women – even if the pitches are identical. In one of three experiments, the exact same pitch was shown to two different groups of men and women, one with a recording of a man and another of a woman. The result was that both men and women preferred the male recording of the pitch, even though the content was identical. More precisely, the man was 60% more likely to receive funding than the woman, and 68,3% more likely in a replication of the experiment. In another experiment pictures were added of different men and women to the pitch deck. And in this case, the audience still preferred the man over the woman – especially if the man was attractive. Investors evaluate women differently from men

As if the playing field wasn’t tilted enough, it seems that investors also have a tendency to evaluate men and women and their companies differently:

E.g. investors are 29% more likely to have investment discussions with male entrepreneurs, and doubly likely to have preconceived perceptions of women-owned companies as doing worse than they actually are (State of Small Business Lending: Spotlight on Women Entrepreneurs, Fundera rapport 2020)..

We ask men to win and women not to lose

The most basic difference between investor conversations with either male or female entrepreneurs is that:

- women are typically asked to prove how they will not fail, while the

- men are asked to prove how they will have success.

Importantly, what kind of questions the entrepreneurs answer have an impact on who gets investments and who does not.

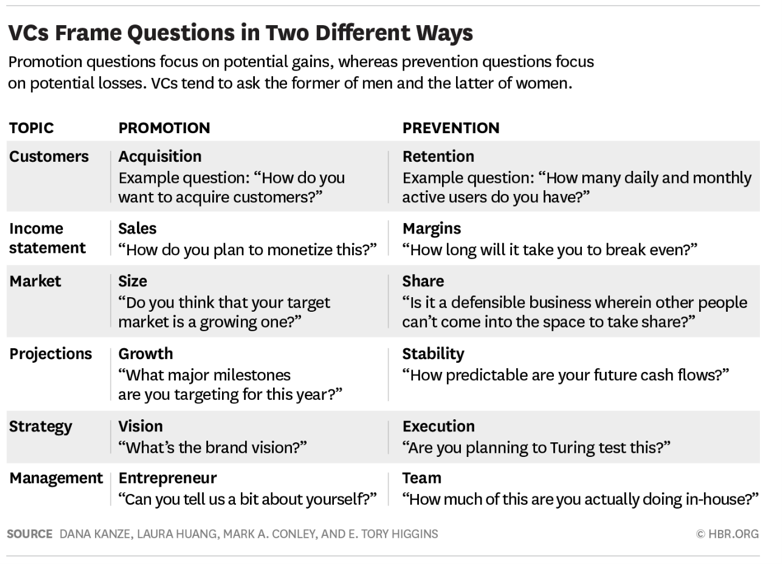

A study in Harvard Business Review found that even in VC-funds with 40% women, 67% of the questions to men were promotion-oriented, while 66% of questions to women were prevention-oriented. That is, the men were more likely to be asked about their dreams, plans, progress and hopes, whereas the women were asked about security, responsibility, garanties and potential pitfalls. See the figure below:

Male and Female Entrepreneurs Get Asked Different Questions by VCs — and It Affects How Much Funding They Get by Dana Kanze, Laura Huang, Mark A. Conley and E. Tory Higgins, in Havard Business Review, June 27, 2017

Imagine a job interview where the male candidate was asked what he could add to the company, but the female candidate was asked why she would not be a mishire. Which of these would present in a way, that would make you hire them? Most likely, the man. The questions you ask, influence the answers you get – and the way you perceive the opportunity.

”Investors ask different questions to women and men. We need more awareness on that, and we need investors and especially VC’s to be better educated in this area.”

– Louise Ferslev, CEO and founder of MyMonii.

The point is, that a larger bet is put on the person that explains his winning strategy, than the person presenting her strategy on how not to lose. The study by HBR found that entrepreneurs who answered win-questions raised 7 times more capital than those entrepreneurs who answered mostly prevention-oriented questions.

“When I reflect on it, and look at the content of this guide, I’m not sure that I would have put the same attention or had the same focus for the founder to perform in some areas if it was male founders. Looking back I honestly feel ashamed and question how much of these matters were grounded in reality and how much was led by my own biases.”

– Frederik Lysgaard Vind, Business Angel

Young men have potential, young women are inexperienced

If you’ve read this far into this article, it should be clear that we all have some unconscious biases – whether based on gender, ethnicity, age, education, sexual orientation, a combination or otherwise. These biases do not only creep up in the questions in the early investment conversation, but stay and influence the following evaluation stage.

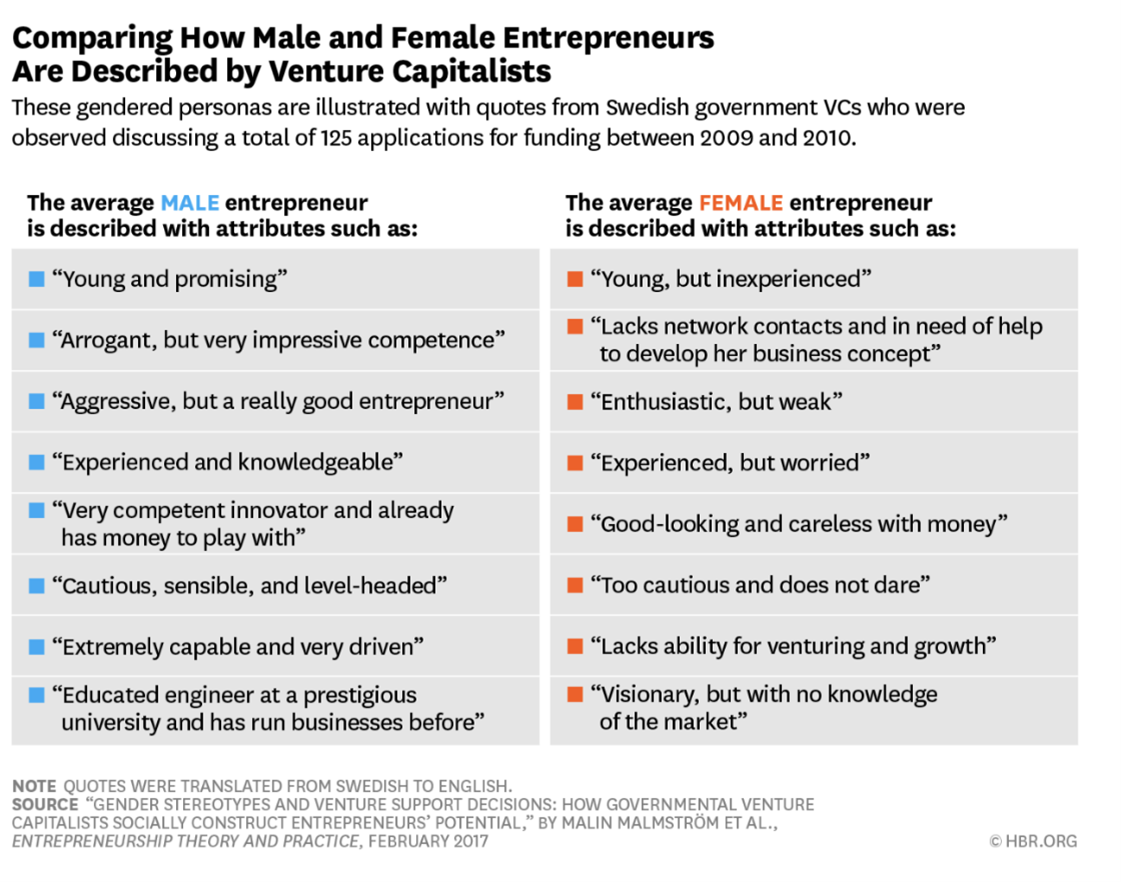

A study of 36 hours worth of evaluation work in a government supported VC-fund in Sweden analysed the language used to describe fund-seeking entrepreneurs (We Recorded VCs’ Conversations and Analyzed How Differently They Talk About Female Entrepreneurs by Malin Malmstrom, Jeaneth Johansson and Joakim Wincent. Harvard Business Review, 17 maj, 2017)

They found that the pictures painted of the women were more defined by qualities not generally seen as important for an entrepreneur. Investors were also more critical towards the skills of women than men. In the figure below, you can see examples of sentences used to describe different entrepreneurs.

The female entrepreneurs in the study received 25% of what they sought for, and were denied funding 53% of the time, compared with 52% of men receiving the amount they sought and only 38% being rejected.

“After we started to look at our own company and our own deal flow, we know that there are a lot of really capable women out there. We are trying to bring people together so we mix and blend our networks. Right now, we focus on identifying all the startups out there where female founders are part of the founding team, as we can see that diversity has a positive effect on the performance of the startup.”

– Tommy Andersen, Managing partner, byFounders.

Please note: What you have been reading now is just a short line up of all the points, views and angles our guide Return on Diversity deals with. Return on Diversity not only sums up the problems within the startup eco system; we propose and deliver the solutions. Follow this series. Together we will unlock the untapped potential in the Danish Startup Ecosystem.

Our articles about diversity will be free to read and in English – and our guide Return on Diversity is as well: Our hope is to reach out to not only Danish founders, investors and VCs about the lack of diversity within the ecosystem, but to all the Nordic countries, so the lack of diversity can be broadly discussed – and acted on. Also, one our main source of hard facts and figures on this topic is the Unconventional Venture Report 2020 by Thea Messel and Nora Bavey that encompass the Nordics.