Albert Einstein once said: “If I were given one hour to save the planet, I would spend 59 minutes defining the problem and one minute resolving it.” This might inspire some on how to look at investing in a world with larger challenges than ever. According to Richard Georg Engström, founder of The One Initiative, it’s not about finding the one and only solution though. In principal Einstein was right, but perfection can easily become a barrier, or even a bad excuse, not to act. And that would be a shame. We need more investors that try to understand the challenges and, more importantly, we need more investors to act accordingly.

This is no. #6 article in a series about Nordic investments in impact, Bootstrapping are publishing from the Impact Report Nordic Investors 2020 in collaboration with The One Initiative. The report is sponsored by +Impact by Danske Bank, Vækstfonden, Novo Nordisk Fonden & Nordic Innovation.

Facts and key figures – Impact Report Nordic Investors 2020

Download a free copy of the report here.

The underlying survey for the analysis was targeted at Nordic and Baltic private equity investors within early stage solutions – primarily business angels, venture capital funds, governmental capital funds, accelerators and family offices. The survey with 51 questions was conducted Q2-Q3 2020 and the report was launched by The One Initiative 9th of December 2020.

WHY INVEST IN IMPACT?

80% think impact investments provide opportunities for a good return.

61% answered that financial returns on impact investments are in line with or outperforming their expectations.

62% answered that their impact portfolio performance is in line with or outperforming held up against the impact expectations.

67% of the investors say that they expect to increase their impact investments.

HOW TO INVEST IN IMPACT?

74% state that they have a longer time horizon when investing in impact.

49% have to be more engaged in their impact investments than traditional investments.

49% see the need for more specialization to invest in impact.

WHAT TO INVEST IN FOR IMPACT?

Nordic investors chose Climate as their preferred theme (20%) followed by AgriFood (14%), Energy (13%) and Health (13%).

40% of investors have 100% of their private equity portfolio in impact investments.

43% of the respondents invest 100% of the private equity impact portfolio in technology.

WHERE DO THEY INVEST FOR IMPACT?

76% of investors invest primarily within Nordics.

Only 16% chose the possibility to have a positive impact as the reason to invest in developed markets.

42% of investors are primarily driven by deal flow and the types of solutions available, when prioritizing a certain market and 11% because of their expertise.

30% of the respondents have chosen impact as the main reason to invest in emerging markets.

Being an investor is not a matter of perfection. It’s a matter of identifying opportunities, believing in the potential outcome, being excellent at mitigating risk – and often accepting that sometimes everything doesn’t go as planned. Investing, a discipline that took off some hundred years BC and got institutionalized with the world’s first stock exchange in the 17th Century, is today a huge and very sophisticated industry. Some say it’s the foundation of our modern economy. It probably is – for the better and the worse – as long as you use GDP as the lens for how well we are doing and financial return of investment as the way to measure success.

But entering a new decade, maybe even the defining decade for the future of humanity with the UN 2030 Goals on the agenda, how should you act as an investor?

We took the opportunity to talk to Richard Georg Engström, founder and executive director of The One Initiative and one of the driving forces for impact investing in the Nordics.

“Looking at the world around us we must admit that leveraging one’s knowhow and risk analysis skills for speculation in financial opportunities might not be the best way forward. Having built a community of almost over 300 Nordic investors the last couple of years, following our different activities, many investors admit this. Pure profit is not how they address success anymore. They instead look for more and alternative possibilities to also do good when doing well.”

Impact investing might not be a huge industry yet. But it’s certainly more than just a temporary movement. A study on 1,700 global impact investors, done by The Global Impact Investing Network, found that aggregate assets under management for solutions with a social and environmental positive outcome increased from $502 billion in 2019 to $715 billion in 2020.

But how do you do that? How do you combine your intention to improve the world for all with a financial return on the capital invested? And what comes first – the impact or the financial return?

In Richard Georg Engström’s opinion you have to add another layer to your fundamental view on capital. Who should your capital serve? He suggests investors ask themselves if it is enough that you (and your LP’s if you manage a fund) gain from the return. Or could your capital also serve others, e.g., an underserved group of people in another part of the world, an environment of importance for more than yourself, the local society you live in or nature itself? Could your capital do good while you are still doing well? Richards answer is obviously yes. But it also reflects the newest insights from the Nordic investor market.

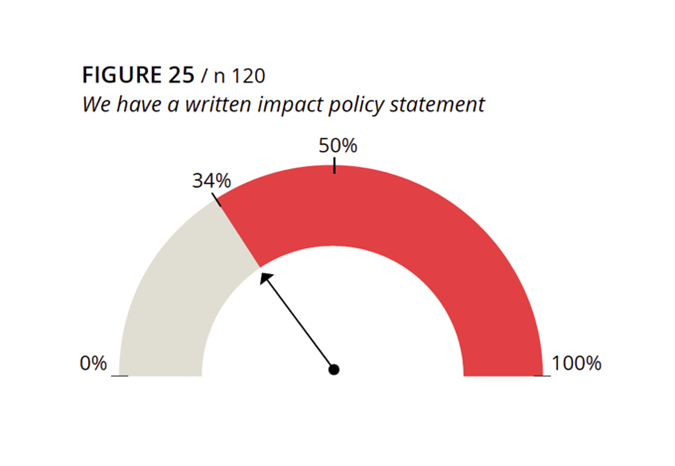

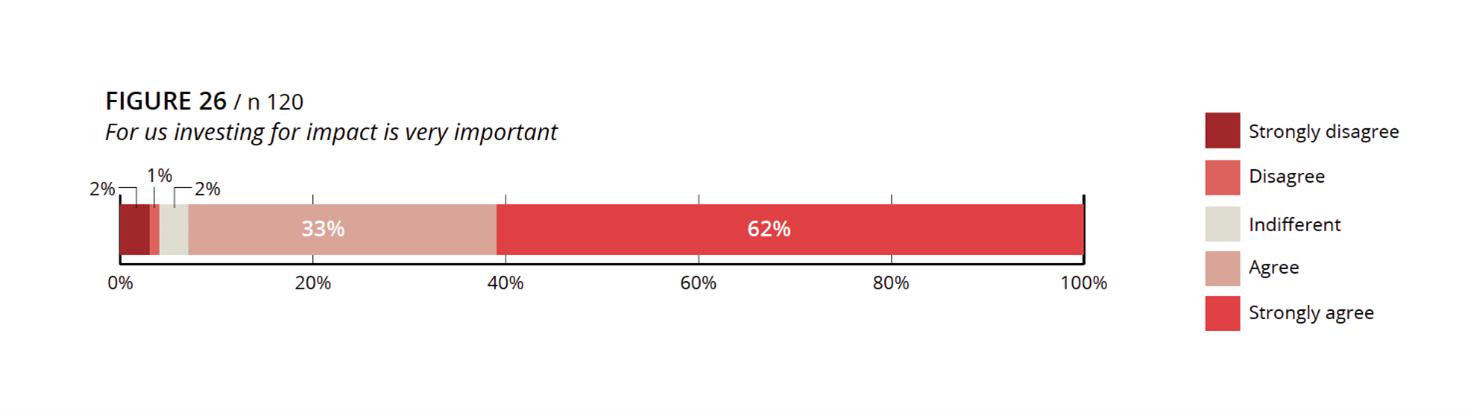

On the 9th of December 2020, The One Initiative presented their second market analysis on impact investing in this region of the world. It shows that a positive social and environmental effect of capital need as much attention and sophistication as the search for profit when investing your capital. According to Impact Report Nordic Investors 2020, some investors have already started to implement this thinking, although most investors yet don’t know how to get going. And even when 95% of Nordic investors (figure 26) agree or strongly agree that a positive social or environmental is important for them, only 34% say they have a formal impact policy statement (figure 25) on how to achieve it.

How could something be of great importance to investors, and still, many of them don’t have a clear idea on how to go about it?

Richard Georg Engström thinks there are several answers to that question.

“I guess the humble answer is that we are all at a steep development curve on how to solve the large challenges in our world. And we have just begun climbing that mountain. To get over that top and enter in a much better world for all of us is not dependent on how much capital you have. It’s about how you use it. Another an even more honest answer would be to also look inward. We have to admit that we are all somehow incomplete – that we are incapable of fully understanding the global challenges we’re confronted with and how to deal with them. A good way to navigate that uncertainty is to try to understand what really matters and to whom.”

Richard emphasizes the responsibility investors can take to see change come faster.

“We are entering a complex era in which we all need to change behavior. New technology is transforming most of our world. Look at our energy systems, the food supply chain and the transportation sector. They have already started to integrate a lot of sustainable solutions. The financial industry and investors must transform accordingly. It’s not an easy task, but fortunately we can collaborate. We can seek new kind of partnerships to gain new understanding. Then new and relevant solutions to invest in will appear. Investors can actually stand on a lot of shoulders we are already used to rely on in the global community of researchers, scientists, engineers and startups proposing the best solutions to invest in. As investors we just have to adjust our view on how capital can have a more nuanced purpose.”

Richard thinks investors have to be curious and look for new answers. To start with they should ask who except themselves can benefit from the investment they do? And investors that aim to invest for a positive impact must investigate the problems continually. Not only on their own, but together with other investors and maybe most importantly together with the problem owners and the startups and other solution providers. But real change starts with action.

“As an impact investor you need to take action. You need to ask yourself what you really believe in and how you can potentially make a difference if you put your efforts and capital into your belief. It’s not much different from what you are used to. But when it comes to solutions on climate changes, biodiversity breakdowns, people migration and waste and toxic trails of economic growth, there a not always clear answers on what to do. So, we better act and at the same time reflect from our progress and failures. We have to look for answers outside ourselves. We have to listen more to learn. At the same time, we need to be bold enough to lead others with our own initial answers on how to make a positive change in the world.”

That is the starting point for investors that have already developed their own version of an impact investing policy and strategy: They ask themselves on how they could contribute and especially to whom.

A good example is Jørgen Balle Olesen, a Danish business angel. His parents founded a bookstore in the 1960’s, which he took over 20 years ago. At that time, he founded SAXO.com and managed it as CEO for many years. Today it is Denmark’s largest online bookstore. Prior to his time in SAXO he worked with education in Bolivia, especially within preventive healthcare learning.

“These two paths of my career have given me the understanding that digitization of reading, with e-books and e-learning, can make a positive difference for people. Today I invest in startups in the educational market. I can leverage a lot of my market understanding together with insights into the South American market. SDG 4, which is to ensure inclusive and equitable quality education and promote lifelong learning opportunities for all, has become my differentiator. It’s where I can and would like to have a positive impact.” as Jørgen himself expresses it.

Jørgen Balle Olesen

Everyone wants to be on top of things. Also, investors. That’s how they mitigate risk. But when there is not yet a strong universal formula on how to improve the world and show evidence for it (compared to an annual report that shows clear evidence for profit or loss), impact investors need to be more explorative.

According to Richard Georg Engström most impact investors don’t strive for perfection though. They prefer to act and honor the possibility to learn along the journey. They define a long-term course and then try to describe what the world ought to look like. Then they combine their own areas of expertise, with the aims to find answers and solutions to some of the challenges in the world, within e.g., food, health, education, water, energy, forestry or estate.

Happily, there are already a lot of individual investor and institutions to learn from. Emerging standards and frameworks have started to appear to give investors an idea on how to act on their intentions to do good.

Being an advisor for investors who would like to invest for a social and environmental positive impact, Richard Georg Engström has developed a four-step method on how to approach impact investing. Although you can embark on impact investing as sophisticated as you like, using his Impact Investment Model, Richard points out that it can all be boiled down to a few essential things:

“Something needs to change. The change happens because you act, not due to something or somebody else. And the search for perfection should certainly not stand in the way for your actions to achieve a better world for all of us.”