This is no. #2 article in a series about Nordic investments in impact, Bootstrapping are publishing from the Impact Report: Nordic Investors 2020 in collaboration with The One Initative. The report is sponsored by +Impact by Danske Bank, Vækstfonden, Novo Nordisk Fonden & Nordic Innovation.

Facts and key figures – Impact Report Nordic Investors 2020

Download a free copy of the report here.

The underlying survey for the analysis was targeted at Nordic and Baltic private equity investors within early stage solutions – primarily business angels, venture capital funds, governmental capital funds, accelerators and family offices. The survey with 51 questions was conducted Q2-Q3 2020 and the report was launched by The One Initiative 9th of December 2020.

WHY INVEST IN IMPACT?

80% think impact investments provide opportunities for a good return.

61% answered that financial returns on impact investments are in line with or outperforming their expectations.

62% answered that their impact portfolio performance is in line with or outperforming held up against the impact expectations.

67% of the investors say that they expect to increase their impact investments.

HOW TO INVEST IN IMPACT?

74% state that they have a longer time horizon when investing in impact.

49% have to be more engaged in their impact investments than traditional investments.

49% see the need for more specialization to invest in impact.

WHAT TO INVEST IN FOR IMPACT?

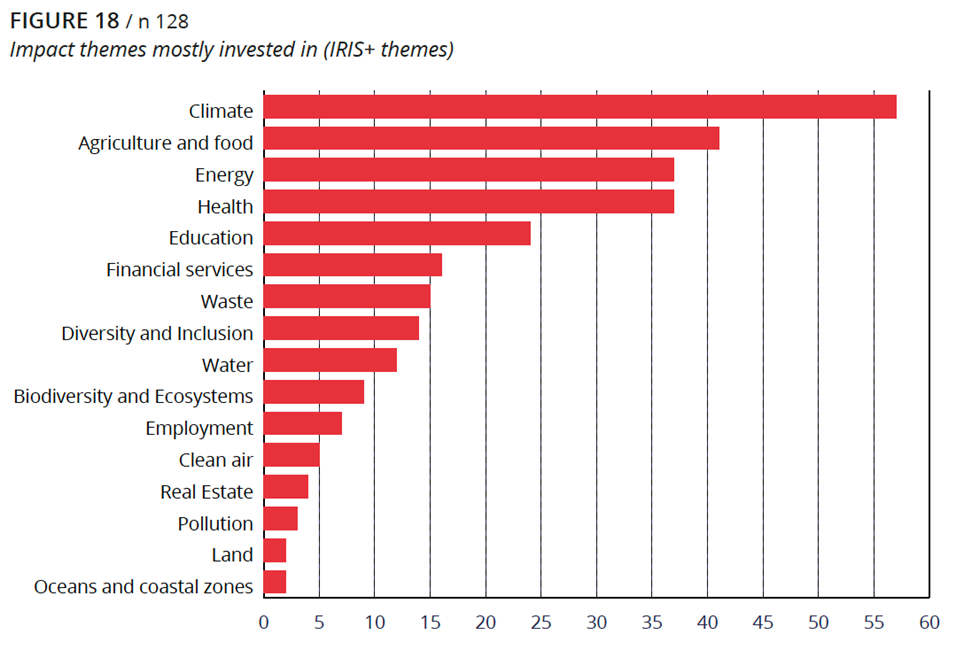

Nordic investors chose Climate as their preferred theme (20%) followed by AgriFood (14%), Energy (13%) and Health (13%).

40% of investors have 100% of their private equity portfolio in impact investments.

43% of the respondents invest 100% of the private equity impact portfolio in technology.

WHERE DO THEY INVEST FOR IMPACT?

76% of investors invest primarily within Nordics.

Only 16% chose the possibility to have a positive impact as the reason to invest in developed markets.

42% of investors are primarily driven by deal flow and the types of solutions available, when prioritizing a certain market and 11% because of their expertise.

30% of the respondents have chosen impact as the main reason to invest in emerging markets.

The climate crisis has received increasing coverage, from newspaper headlines to executive boardrooms. This has trickled down to the focus areas through which impact investors are looking to contribute – and invest their capital.

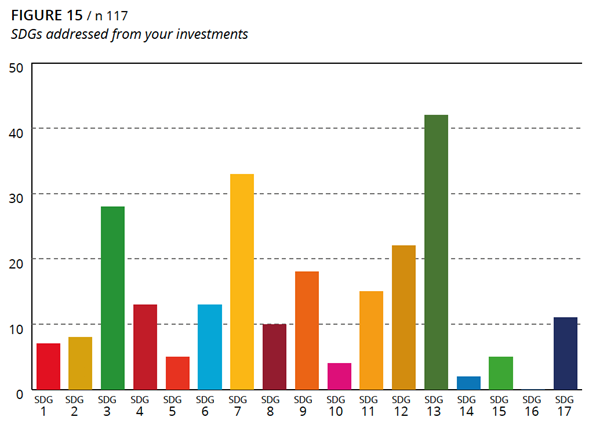

When asking investors about which of the SDGs is the most important (Figure 15), the most common responses were SDG 13: Climate Action, SDG 7: Access to Clean and Affordable Energy and SDG 3: Good Health and Wellbeing – followed by SDG 12: Responsible Consumption and Production.

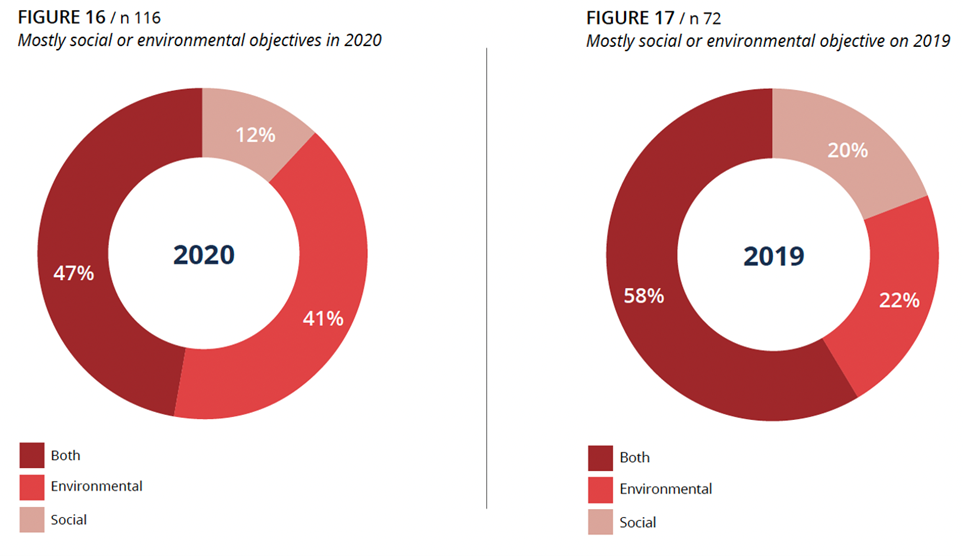

As an increasing climate crisis has drawn attention to the need for a decarbonized industry, such as clean energy and responsible consumption, Covid-19 has drawn attention to the importance of public health. Figure 16 & 17 paint a similar picture, with the climate and the environment taking higher priority within investors’ agenda, than in last year’s report.

Almost half of the survey respondents for Impact Report Nordic Investors 2020 state that they invest in both environmental and social causes, whereas 41 percent invest in environmental causes and correspondingly 12 percent invest in social causes.

In order to assess desirable areas of investment for impact investors, the report have used the widely accepted IRIS+ impact categories (figure 18). Nordic investors chose Climate as their preferred area followed by Agri-Food, Energy and Health.

Tackling climate change starts with recognising the unknowns

As we can see from this year’s survey results, SDG13 Climate Action is the UN Sustainable Development Goal highest on the investors’ agenda, as well as the focus area they would most like to invest in. Hampus Jakobsson, General Partner & co-founder of the Swedish climate VC Pale Blue Dot, has a clear idea on why.

“In 2018 Great Thunberg initiated the ‘Friday’s for Future’ demonstration outside the Swedish parliament. In 2019 Amazon announced it will meet the terms of the Paris Climate Agreement 10 years ahead of schedule. And in 2020 PwC launches the report ‘The State of Climate Tech 2020’ – a first-of-its-kind analysis of the state of global climate tech investing. The discussion is moving incredibly fast, evolving from youth activism, to an organised and conscious movement, with the involvement of global players. And that’s just in three years. That’s good.”

Hampus anticipates the need for behaviour change, also amongst the investment community. In his view, it’s not enough to look for scalability and financial returns, at least not if investors want to play a real part in climate change solutions:

“This need to change behaviour and attitudes can be seen when we are assessing deals. We do due diligence as carefully as we can, but we’re not chemists, biologists, physicists. It’s like sitting on the school bench again in ninth grade, raising your hand and for example asking ”What is an enzyme?”. I think 99% of people hate that feeling. I imagine that many investors have a hard time admitting that there are things they don’t understand when talking to impact startup founders. But we have to try to understand it as best as we can and admit when we don’t. There’s a reason why we still use fossil fuels and haven’t come up with anything new. No one has dared to raise their hand. It takes great humility to admit that you do not know best.”

For this reason, Pale Blue Dot embarks on a detailed research process when they are considering investments. They produce a comprehensive article about what to invest in, about the whole subject and the problem to solve. The aim is to make this as scientific as possible in order for them to understand whether the venture is a good investment from a climate perspective. At the same time they also outline all of the unknowns, so that they can find partners who can contribute with the right knowledge.

Hampus explains: ”You have to have that attitude. There isn’t room for those who aren’t willing to admit that something is complex, but who try to play cool and bullshit. We aim to be the ones in the front row of the classroom telling the teacher that we do not understand. When you sit on something as powerful as capital, and not just your own, you have to be incredibly humble and admit that you do not know everything. And climate change undeniably is a complex thing.

I still hold a fundamental belief nonetheless that you can find the core of the problem and at the same time identify the potential in the investment if you use the three magic words more often. ‘I don’t know’.”