This is no. #3 article in a series about Nordic investments in impact, Bootstrapping are publishing from the Impact Report: Nordic Investors 2020 in collaboration with The One Initative. The report is sponsored by +Impact by Danske Bank, Vækstfonden, Novo Nordisk Fonden & Nordic Innovation.

Facts and key figures – Impact Report Nordic Investors 2020

Download a free copy of the report here.

The underlying survey for the analysis was targeted at Nordic and Baltic private equity investors within early stage solutions – primarily business angels, venture capital funds, governmental capital funds, accelerators and family offices. The survey with 51 questions was conducted Q2-Q3 2020 and the report was launched by The One Initiative 9th of December 2020.

WHY INVEST IN IMPACT?

80% think impact investments provide opportunities for a good return.

61% answered that financial returns on impact investments are in line with or outperforming their expectations.

62% answered that their impact portfolio performance is in line with or outperforming held up against the impact expectations.

67% of the investors say that they expect to increase their impact investments.

HOW TO INVEST IN IMPACT?

74% state that they have a longer time horizon when investing in impact.

49% have to be more engaged in their impact investments than traditional investments.

49% see the need for more specialization to invest in impact.

WHAT TO INVEST IN FOR IMPACT?

Nordic investors chose Climate as their preferred theme (20%) followed by AgriFood (14%), Energy (13%) and Health (13%).

40% of investors have 100% of their private equity portfolio in impact investments.

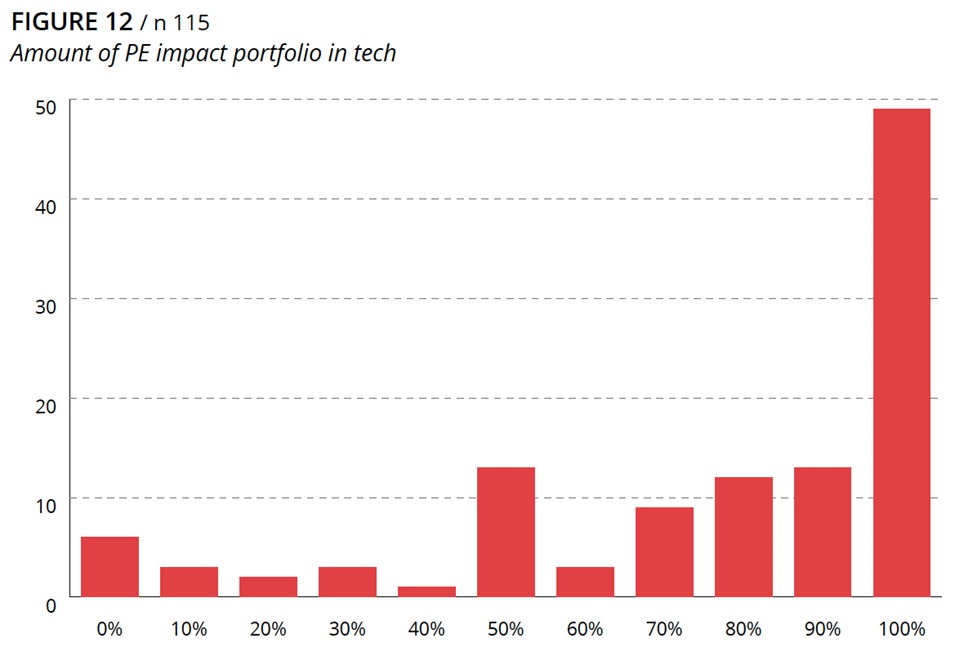

43% of the respondents invest 100% of the private equity impact portfolio in technology.

WHERE DO THEY INVEST FOR IMPACT?

76% of investors invest primarily within Nordics.

Only 16% chose the possibility to have a positive impact as the reason to invest in developed markets.

42% of investors are primarily driven by deal flow and the types of solutions available, when prioritizing a certain market and 11% because of their expertise.

30% of the respondents have chosen impact as the main reason to invest in emerging markets.

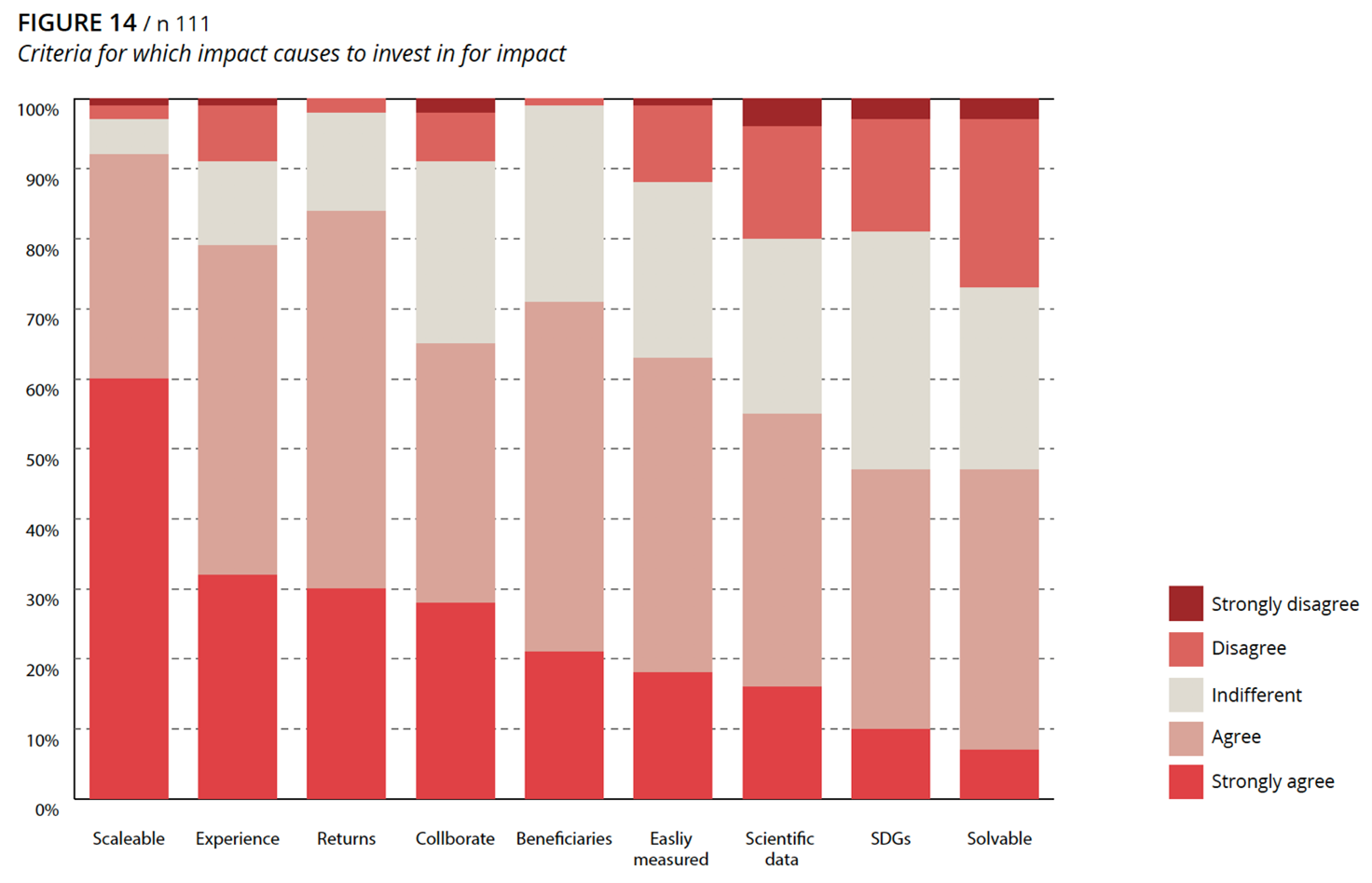

When investing in impact, there are many things to consider before deciding on a primary cause. In the Impact Report: Nordic Investors 2020, we asked the respondents to reflect on a number of decision-making criteria. Though the answers vary, the vast majority of respondents emphasize scalability.

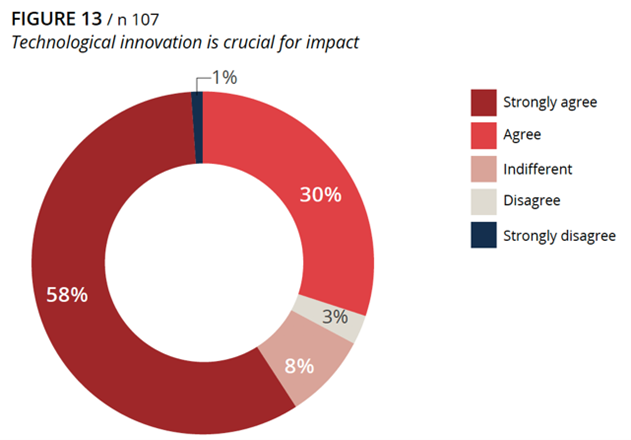

The desire for scalability, high financial returns and the opportunity to contribute on domain specific topics are prime concerns for investors in general – and this is no different when it comes to impact investing among our respondents. They also consider that technology is an important factor when it comes to their private equity investments for impact. In their view, social and environmental problems must be solved through technological products and services.

Figure 12 shows that almost half of the respondents invest 100% of the private equity impact portfolio in technology.

Figure 13 shows that a large majority strongly agree with the idea that technological innovation is crucial for considering an impact investment. Moreover, it is not simply altruism which drives the investment in impact.

Figure 14 shows the reasons our respondents invest in impact. Most decide to invest in causes that have potential for impact at a big scale.

A large majority state that they decide on causes in which they expect good investment opportunities and returns. Almost as many of the respondents choose to invest in areas where they already have the expertise or network. Figure 14 further shows that a large majority prefer to invest together with other stakeholders.

As it is often the case that impact investments in the earlier phase involve some risk, many would like to include others to get additional expertise from co-investors and balance this risk. Despite this not as many investors seek in-depth knowledge of the data and science available before investing, neither do impact measurement mean as much in deciding on the cause to invest in.

Anette Nordvall: Scaling is just one way of looking at your business

Whether a venture is scalable – or not – is a fundamental consideration for many investors when assessing the viability of a business. Scalability has become synonymous with tech startups with some of the leading startups having scaled to nearly every country in the world.

Anette Nordvall, Chapter Presindet and board member of Keiretsu Forum Nordics (KFN), who has a history as both a tech and impact investor, believes that scaling is a specific way of thinking which has become very widespread in business today:

“It’s become a bit of a buzzword but in essence scaling is a way of thinking. As a concept it can be used from both an investment and operational point of view, whether it be to assess how far an investment can go or whether a company’s logistics can be replicated. People often ask: is there a way I can scale my business so that it’s more efficient? We are still enticed by the idea of exponential growth, like with Twitter and Facebook, where scaling doesn’t stop until you’ve reached everyone on the planet.”

Anette Nordvall

Anette Nordvall of course considers this when looking at her own investment, but also believes that technological adoption is not always synonymous with impact. She explains:

“Many people think that if you do not have a viable technology, you need lots of manpower to create impact. They think you have to be there to physically distribute water in the third world because that’s what impact looks like. But this does not have to be the case. There may be better water solutions on location to remedy polluting industries. We will still have dirty industries for many years to come, so it’s an important conversation in which leaders need to take a standpoint.”

The winds of change are gathering strength

Anette Nordvall sees an increase in emphasis on impact investments, especially after large asset management companies such as BlackRock have moved their assets into this market.

”Back in February 2020, the CEO of BlackRock, Larry Fink, made a public statement that they would not invest in something that is not green. These are some of the largest fund managers in the world. When they say such a thing, the whole market changes. CNBC’s Jim Cramer also made a statement that oil and other fossil fuel stocks are now considered the same as tobacco stocks. These kinds of statements have made people question their choices and think to themselves ‘Oh… I have some bad investments lying around that I need to get rid of.’”

Over the years, Anette Nordvall has invested in a lot of software ventures but she nonetheless has a penchant for hardware and believes there is great potential in making hardware smarter:

“There are few products today that do not have some kind of software connected to it. In the future, I believe there will be some form of AI and machine learning integrated in the same way.”

Covid-19: A digital revolution with a tragic backdrop

In general, she holds great confidence for the future of impact investment. And while Covid-19 has been a curse, and she’s truly sorry for all the hardship and the many lost lives during this period she also believes it could be a blessing in disguise in other areas.

“Prior to Covid-19, I couldn’t see how we could make the kind of big shifts that were necessary as most capital was still being invested in fossil fuels and the companies fuelled by them. But Covid-19 has changed this. I no longer have to fly to Finland to attend a conference. I’ll participate over Zoom instead. This has changed our consumption habits forever, our thought process and view of the future. Covid-19 has been an obvious turning point for sustainability. And we consequently take action in another way.”